Lin-gang enterprises benefit from offshore trade stamp tax exemption policy

China recently witnessed a significant expansion of the offshore trade stamp tax exemption policy, marking a crucial step forward in promoting the high-quality development of offshore trade. This policy, initially piloted in the China (Shanghai) Pilot Free Trade Zone, or Shanghai Free Trade Zone, and the Lin-gang Special Area, has now been broadened to include seven free trade zones across the country.

The pilot program in Shanghai, which commenced on April 1, 2024, has achieved remarkable results. Over the past year, the policy has reduced stamp taxes by 182 million yuan ($24.93 million), benefiting 377 enterprises spanning industries such as energy, electronics, and medical equipment.

Offshore trade is a trade method where goods do not enter the domestic market. Instead, domestic traders buy and sell foreign cargo rights, allowing goods to be transported directly from the exporting country to the importing one.

Stamp tax is the primary tax involved in this business, typically levied at a rate of 0.03 percent of the contract amount for written contracts in both the procurement and sales stages.

The pilot policy's exemption of stamp taxes on offshore trade has significantly reduced operating costs for enterprises and enhanced their capital utilization efficiency. This has led to an increase in the number of enterprises engaging in offshore trade in the Shanghai FTZ and the Lin-gang Special Area, with 110 new enterprises recently getting involved, including 40 foreign-invested enterprises.

In total, 215 foreign-invested enterprises are now conducting offshore trade, accounting for 57 percent of all enterprises benefiting from the tax exemption policy and over 65 percent of the total tax exemption amount. These figures underscore the policy's effectiveness in stabilizing foreign investment and foreign trade.

-

Address No 200 Shengang Avenue, Pudong New Area, Shanghai, China

-

Zip Code 201306

-

TEL +86-21-68283063

-

FAX +86-21-68283000

Lin-gang Special Area welcomes the Year of the Snake with fresh decor

Lin-gang Special Area welcomes the Year of the Snake with fresh decor

In pics: Admire beauty of Lin-gang's colorful foliage in winter

In pics: Admire beauty of Lin-gang's colorful foliage in winter

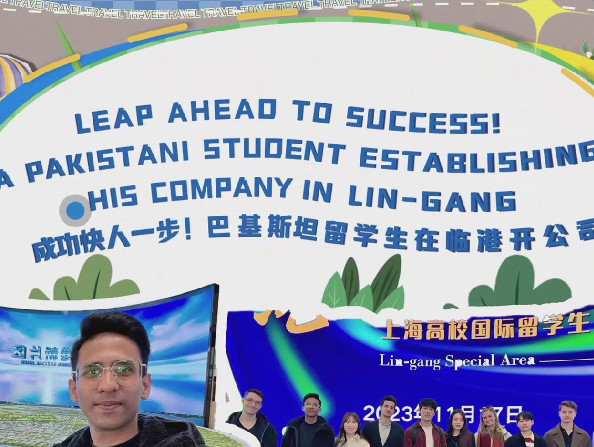

Video: A Pakistani student establishes his company in Lin-gang

Video: A Pakistani student establishes his company in Lin-gang